Discover Why Dividend Income Can Be The Best Way To Your Prosperity

- Alex Artenie

- Jan 4, 2024

- 8 min read

Updated: Jan 13, 2024

Why do you go to work every single day? Isn't that for receiving a regular and stable income? Then why would you dream about winning the lottery for $1,000,000 and being rich overnight? Are you working for ten years to get a big one-time payment? No, you don't.

Then why wouldn't you dream about a passive, regular, and stable income? This is precisely what you need to quit a job that you hate. Replace your hard-worked earnings with a passive source so that you can cover your expenses and have the time to do what you love.

An excellent way to achieve that dream is Dividend Income.

My name is Alex, and this is the first post in my new Dividend Investing Blog. I embarked on the Financial Freedom journey a few years ago, and I learned a lot of extraordinary things about investing. These are things and experiences that I want to share with you through my writing so that you can also reach your Dividend Horizon.

Welcome aboard, and let's get started!

How Dividend Works

First of all, you need to understand that owning a company's shares, or stocks, is not some abstract thing. Being a shareholder means that you actually own a part of the company. Of course, you will most likely purchase a few shares in the beginning, which means you will hold only a tiny portion of the company, but you are still an owner.

As a company owner, you are eligible for certain aspects. For example, you have voting rights! Yes, you can vote for the directors to be hired or about major corporate decisions.

I had a tremendous, satisfying feeling when I submitted my first vote as an Apple owner some long time ago. I am sure you will also enjoy that on your turn, even if you will hardly change something.

But besides the voting rights, there is a more practical aspect for you and me that we are eligible for. And that is Dividend Payments.

Companies that pay dividends decide upon the amount for every single share outstanding. Then, they pay you that amount multiplied by the number of shares you hold. That happens regularly, usually every quarter.

Simple, isn't it?

Let's work out an example.

The Coca-Cola Company (KO) pays an annual dividend of $1.84 for each of its shares (as of January 2024). So, if you own 100 shares, you will receive $184 every year. The dividend is paid quarterly, which means you will receive a quarter of that every three months, i.e., $46 four times a year.

Isn't that amazing?! You don't have to lift a finger. Anything you have to do is to own those 100 shares! The money will be automatically credited to your investing account.

For your reference, I got the information about Coca-Cola dividends from SeekingAlpha, a reputable investment platform.

Of course, you have to purchase the shares in order to have them. As of January 3, 2024, those 100 shares will cost you $5982.

You might think that is a lot of money, and yes, you are right. But the good thing is that you do not need to buy all of them at once; you can buy as many shares as you can afford regularly.

Yes, Dividend Investing is a long-term game. Having a decent dividend income would require a lot of time, so prepare yourself with patience. But it is worth it, I promise.

That was, in very short, how dividend works. There are many other details and lessons to learn, but I want to take you easy and keep this article simple.

By the way, if you haven't done so, consider subscribing to my blog so that you will get notified about future articles that will teach you much more about dividend investing. You will also receive a small welcome gift for FREE.

Now, let's head to the next chapter.

What Dividend Yield is Good?

In our previous example, Coca-Cola is a stock paying a $1.84 annual dividend per share, while the share price is $59.82. This translates into a yield of 3.08% (yearly dividend divided by share price times 100%).

Now, is this good or bad?

It depends.

People have different financial targets, and every stock has pros and cons. Thus, it is a difficult question to answer simply. More about evaluating companies with dividends in future articles; for now, I want to let you know that many stocks yield significantly more than 3.08%.

But please be informed that the dividend yield is by far not the only factor to consider when selecting a stock to invest in. If it were that simple, I would have started this blog, right? But for now, let's address the question, "What dividend yield is good?"

Well, the top 25% of dividend payers in the US market yield 4.5%, according to SimplyWallSt, another reputable investing platform I frequently use. Thus, we can consider any yield around that or higher good.

Personally, I aim for a dividend yield in my portfolio of 5%, so I am even a little bit more selective.

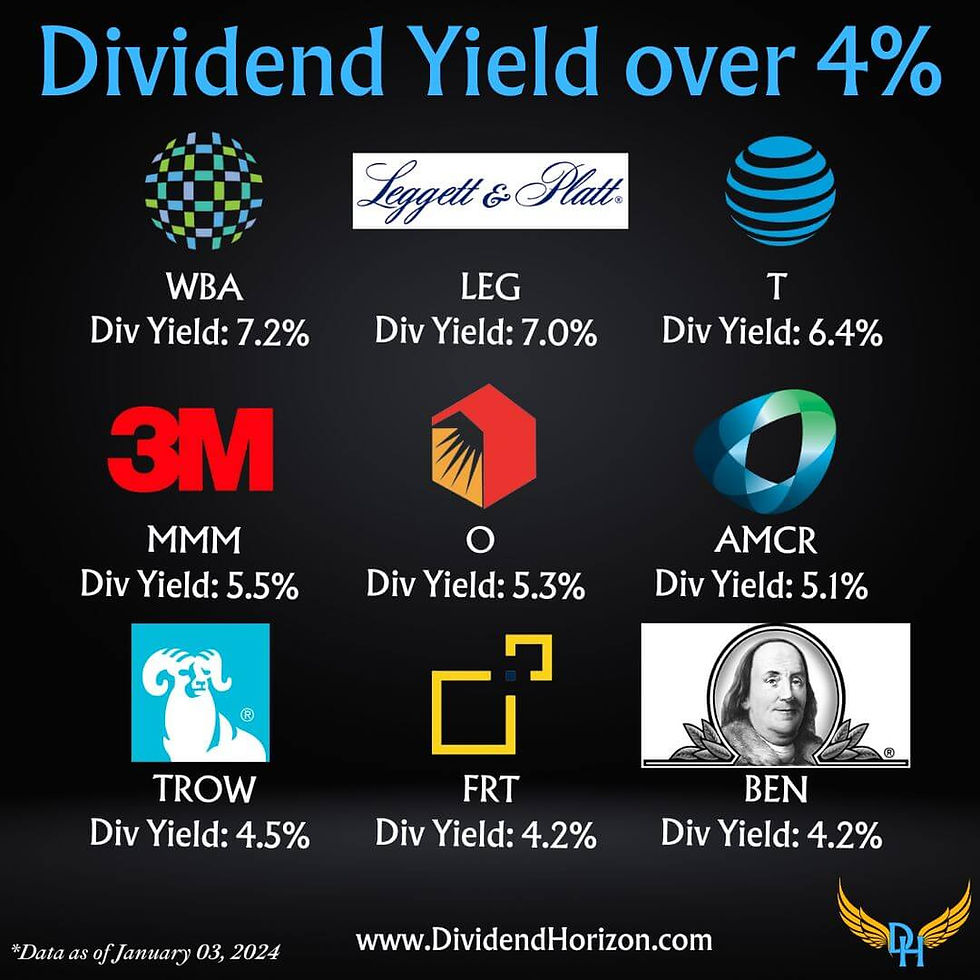

Below is a small list of companies yielding over 4% and have consistently been paying dividends for over 25 years. They are called Dividend Aristocrats.

As you can see, some companies pay dividends as high as 7%!

Be aware! High dividend yields can often signal instability, and they could be unsustainable!

I hope you have some insights now!

Next, I invite you to learn about a fundamental principle that makes dividend investing attractive.

Dividend Growth Model

Some of you work hard and do your best, hoping to receive a salary raise next year. So do I...at the moment...

But guess what! A Dividend Portfolio also gives you "salary" raises, called Dividend Growth.

Companies do not simply pay a fixed amount of dividends. They also raise them regularly. And the great thing is that you do not have to lift a finger again. You must pick the right stocks and watch for your ever-increasing dividend income.

Of course, there might be the case that some companies cut the dividend, no doubt. I never promised it to be simple, did I?

Imagine that you bought a bunch of stocks once. Then, without doing anything else, not only do you get that passive payment, but it also keeps increasing, perhaps keeping pace with Inflation and your lifestyle!

I'm not sure how it sounds to you, but it makes me fall in love with dividend stocks!

One step back to Inflation. According to WorldData, the average US inflation rate was 3.8% per year from 1960 to 2022. That means the average cost of living increased by 3.8% per year.

I mentioned that dividend growth can face that and also improve your lifestyle. To prove that, let's look at some stocks with a high dividend growth rate, higher than 3.8%.

Or wait... No, that is not good enough to convince you. I need to get the challenge further...

Let's check for some companies with a Dividend Yield of more than 4%, increased their dividend payments by more than an annual average of 3.8%, and were raising their dividends for more than ten years. Note that the annual growth rate is referenced as CAGR (Compound Annual Growth Rate).

I've got 6 of them only on my current watchlist!

If you think that was all my arguments about why dividend income can be your way to financial freedom, I've got one more!

Dividend Reinvestment Program

Say you are 30 years old, still working and receiving your paychecks from your employer. Retirement is still far away. Assuming that is sufficient to cover your expenses, you do not need the money you received as dividends yet.

What will you do with them? For sure, you will not pile them in your account sitting as dead cash, which is eaten by Inflation. No, you will buy more shares using that money! Those extra shares will produce more dividends on their own. You will use the extra dividends to buy even more shares. Oh, and don't forget that these extra dividends will also increase in time during the company's regular dividend raises. This dance can go on and on forever!

This is the tango of Dividend Reinvestment!

The Dividend Reinvestment and Compound Interest are the keys to wealth creation. Think of it like "Money Generations" that work tirelessly for you. So, if you want to truly take advantage of dividend investing, prepare to not touch your regular payments. This will pay off later; be sure about it.

Do you want an example? OK, let's work out one.

The math here gets complicated, and I am not sure you are interested in it, so I will use the dividend calculator from TipRanks to make a simulation.

Say you own 100 shares of T. Rowe Price Group (TROW). That would cost you $10630 today and yield you about $476 per year, which will raise by 11.75% per year on average, money from dividends that you will start spending from day 1.

In 20 years, you would have received $33,572, and your annual paycheck would rise to $3,959.

That is quite impressive, but it is incomparable to your achievements if you re-invest all the dividends.

The image below depicts the outcome of 20 years of discipline in re-investing all the dividends received from your holdings of 100 TROW shares.

You were paid $228,990 of dividends, which you used to accumulate more shares (1266 newly acquired). All these owned shares would then generate $70,578 for you every single year. That is a yield 17.5 times higher compared to the achieved yield with no dividends reinvestments!

I bet this is an argument that cannot leave you cool!

Of course, this is only a simulation based on a particular stock's past and present data. But still, this is how it works, and this is the true power of dividends.

Final Words on Dividend Income

I hope you enjoyed this very first article of my blog and you are considering dividend investing as a viable path to achieving your financial freedom. The critical thing about that is to have a stable and reliable source of passive income that covers your expenses and lifestyle.

I am sure that I will reach that target through the principles of Dividend Investing, Growth, and Reinvestment. Perhaps I have inspired you to do the same.

If so, consider sharing this post so that I can inspire more people on this common journey.

I wish you reach your Dividend Horizon,

Alex

FAQ about Dividend Investing

When is the Dividend Paid?

The most common dividend payment is quarterly. That means the shareholders receive one-fourth of the annual dividend declared every three months. Some stocks pay dividends every month, for example, Realty Income (O), or stocks that pay dividends once per year, for example, Allianz SE (ALIZF).

How Dividend is Paid?

The dividend is credited into your investing account on the payment date. You can then withdraw that money or re-invest it to buy more shares. An investing account is where you make your transactions in the stock market, and a brokerage firm provides it. A well-known example of a broker is Interactive Brokers (affiliate link).

How Many Dividend Stocks Should I Own?

It is a perfect practice to own shares of more companies. This principle is called diversification, and it helps investors to protect their investments in case a company declines or goes bankrupt. However, you should also not over-diversify as this could lead to you not correctly tracking your holdings any longer. A good number of shares to own is 25. This is sufficient to build a healthy diversified portfolio, but on the other hand, still remember what stocks you own and can track and monitor them.

.png)

Comments